.png)

January’s job numbers were absolutely stunning. A total of 517,000 jobs were added to the economy during the month, beating the average monthly job growth of ~400,000 new jobs per month in 2022.

Among the top industries contributing to this stunning report were leisure and hospitality, professional and business services, and healthcare. Employment also increased in government, partially reflecting the return of workers from a strike.

The odd part is that there are not that many jobs leaving the economy. Information, which accounts for a small fraction of jobs anyways only saw a net 5,000 jobs leave and Utilities saw only 700 people get laid off.

In my post a while back I wrote about how strong payroll reports was a sign of a weakening economy, mainly because we were seeing job openings fall and the level of unemployed persons stay flat.

Now we are seeing openings begin to rise again and the unemployment rate fall even further.

My case was that as companies begin to slow hiring or freeze hiring job seekers would start seeking jobs where ever they could find them. Effectively keeping the unemployment rate low and the job openings falling.

Could it be that more people are just needing to enter the workforce. Since November the labor force participation rate has crept up slightly, but it’s still not at pre-pandemic levels.

These people entering the workforce would need to find jobs in leisure and hospitality and professional business services, since those are the only sectors really hiring at mass.

But it couldn’t possibly explain the spike in new jobs.

Jobs are an important part of the economy and inflation. Jerome Powell was interviewed on Tuesday and during that interview he was asked if he knew how many new jobs were added to the economy and what his response to that was.

When there are more jobs than job seekers, job seekers have immense leverage. When job seekers demand more money job suppliers have no choice but to comply.

That in turn causes inflation to tick higher, an unfortunate side effect of cooling inflation is to cool the labor market and cause people to either not get hired or get fired.

Jerome Powell stated that the jobs report is the very reason why he believes further rate hikes are necessary.

What we need is a recession, something to reset the economic clock back to normalcy. That means that we can’t have a trillion dollar gold coin this time to save us. We need to experience the slow and steady business cycle process.

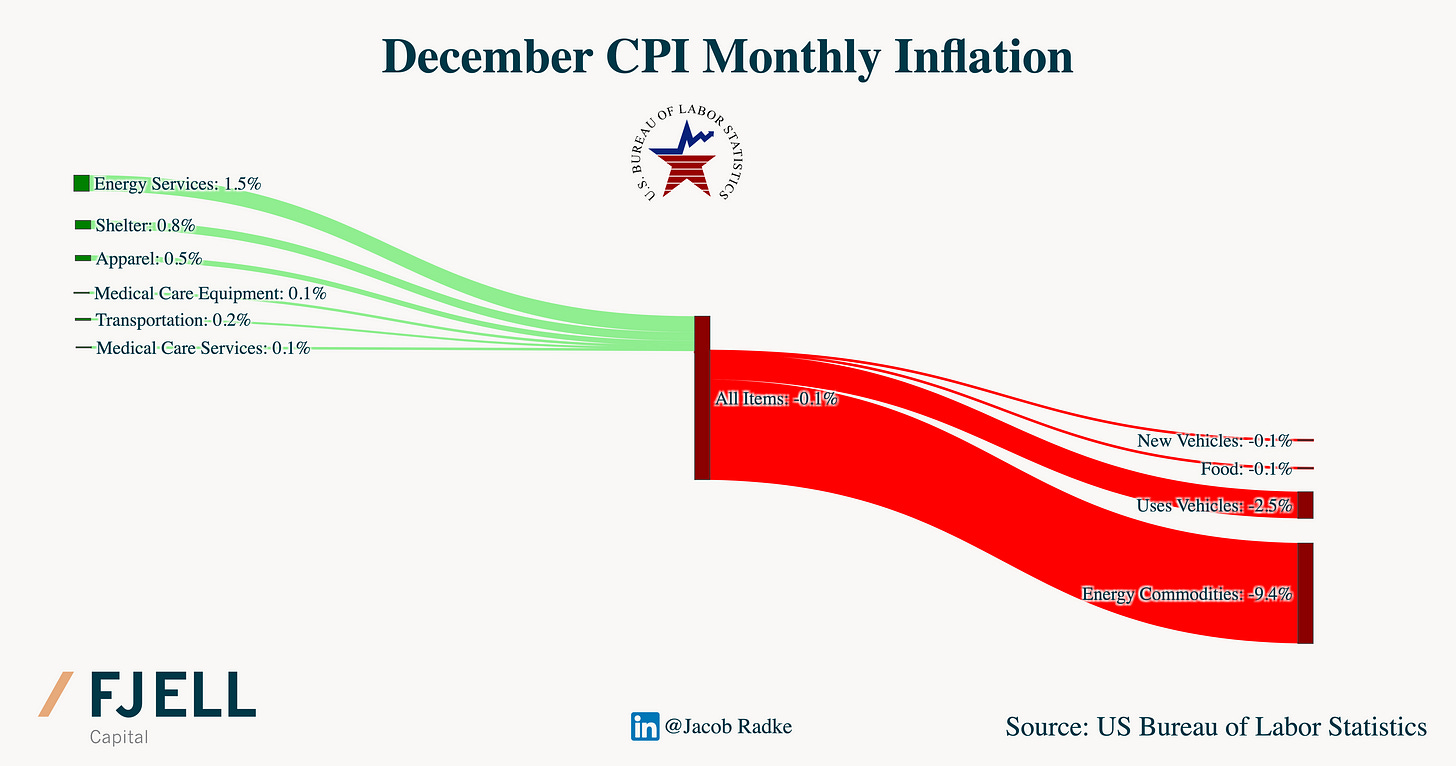

What Jerome Powell has said twice now is that we are beginning the disinflationary process. Which can really be seen in the chart below.

Thank god for lower gas prices because without those we would likely be facing still peak inflation, as Europe is still experiencing (somewhat).

We will get January’s CPI inflation report on Tuesday next week. Hopefully we see a contraction again as we did in December’ report to continue the strength of the markets we have seen so far this year.