.png)

TDLR; market action on strong payroll reports is telling us to sell, but it isn’t a selling signal, it’s a buying signal. Strong payroll reports are telling us of a weakening economy, not a traditional strengthening economy.

Out of the approximately 160 million people employed, 1.79% of them work in information, but about 25% of the US stock market exists in the information sector. Whereas professional business services, health care, leisure and hospitality, manufacturing, etc. make up much more of the workforce, yet they each individually represent a smaller piece of the pie when it comes to valuation and market cap.

Jobs are an important metric to gauge to strength or weakness of the US economy and US consumers. If people are still wanting to spend, they tend to spend on travel, discretionary goods, and other services. If they are spending in those areas, those sectors will need to employ more people.

Since they employ the most people already any fluctuations in those employment numbers are significant.

But over the last couple of years, people have been leaving or have left these sectors. People no longer want to serve food at restaurants, wait on people in a hotel, work on an assembly line, be a nurse, etc. Either they got enough money from stimulus to hold them off from returning to those jobs, which tend to be stressful, or they were worried about Covid-19, and it quite possibly could be both.

When you think about where open jobs are, it’s in those sectors, and here’s why.

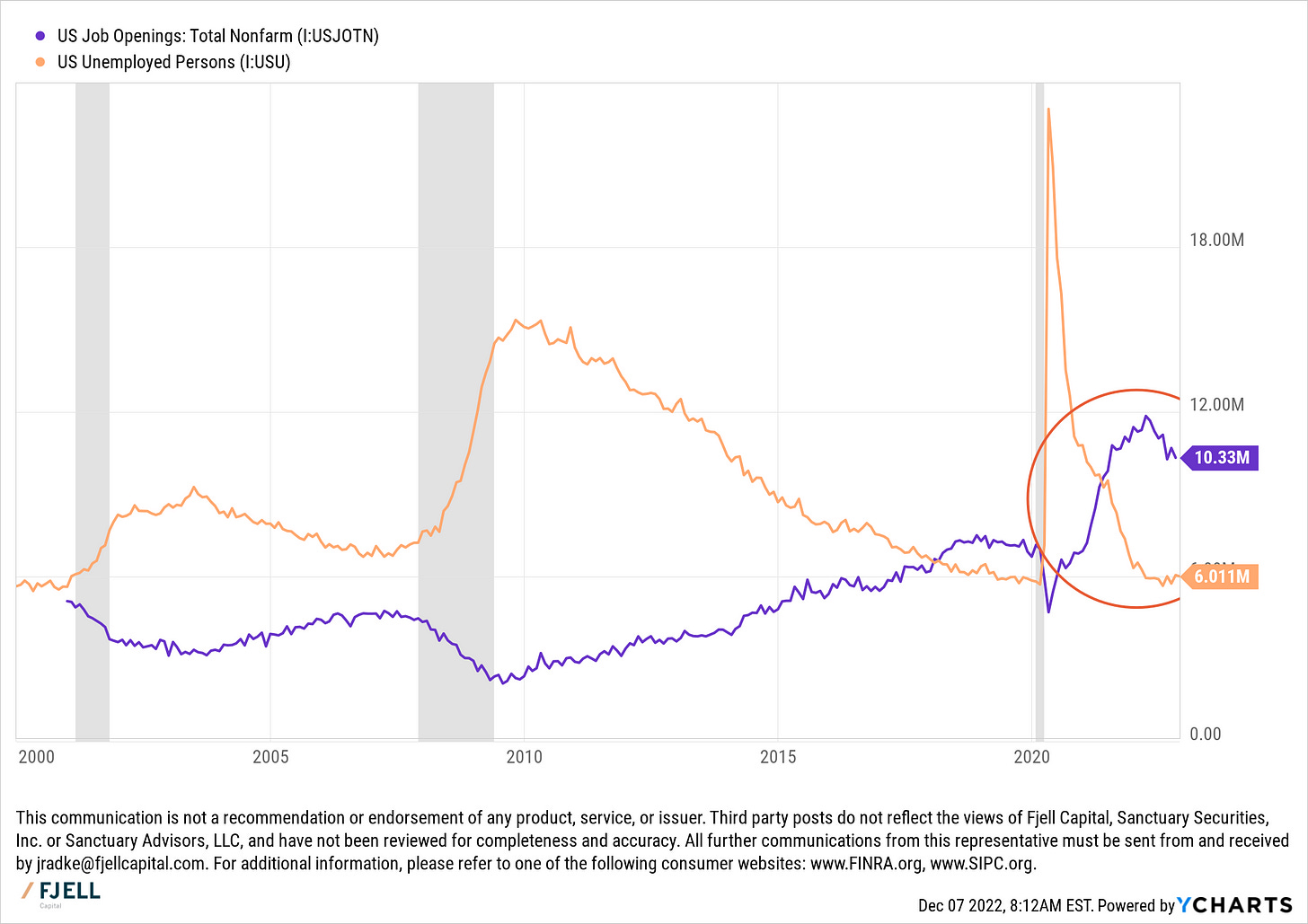

First off, it rarely occurs where there are more jobs open than there are unemployed people looking for one. This will be important later.

But if information represents the same piece of the pie of job openings as it does total jobs taken, then there are only 184,907 jobs available in technology. Compare that to the same relationship that the other heavy-hitting sectors have.

Professional and Business Services would have 1.39 million jobs, health care would have 1.31 million jobs, retail trade would have 1 million jobs, leisure and hospitality would have 921 thousand, and manufacturing would have 800 thousand jobs. That means there are nearly 30 times more open jobs in these sectors than in information.

Those are the jobs that are vacant and those are the sectors that are having a hard time hiring.

Think about how you haven’t really been able to go inside a McDonald’s to eat because they haven’t been able to hire enough people, or how hotels operate at 50% capacity because they can’t get enough people to clean rooms.

So when you hear about the technology sector laying off 10% of its workforce, you shouldn’t make much of it because that is an insignificant piece of the pie, although if you are a laid-off tech employee we all empathize with you. It’s never a good thing to lose your job.

Now here’s where things could take a turn, however.

People that are leaving the job-losing sectors like information and communications, might just be looking to get new jobs potentially in the job-demanding sectors. You, a software engineer, may be becoming a waiter or waitress for a short while until labor market dynamics are back in balance, and that goes for many jobs sectors as things normalize.

What that does to the labor market is it pushes down the number of available jobs and keeps the same number of unemployed people. And I’ll highlight that on a chart for you.

You can see that the level of unemployed people hasn’t really changed but the number of openings has come down significantly. There are two factors at play here. The first is the unwinding of openings in the first place, and the second is laid-off people are seeking new jobs.

This is why you are still seeing jobs being added to the economy. People are running out of stimulus money and needing to return to work, people could also just generally be less worried about Covid-19, if that were the case they had for leaving.

Market action on payroll reports has generally been negative but as my title suggests we may see a spike in the number of new jobs being added before we see a reversal.

What could happen is mass layoffs in different sectors of the economy could start happening, but because you can still get a job elsewhere payrolls won’t change or will rise as job-demanding sectors haven’t reached job capacity yet. That will all change when the US consumer decides that they are nervous about spending and start to not go out to eat as much, or take the kids to Disneyland. A change in consumption habits is a bad thing for service sectors, which employ a near 60% of people.

Now let’s get to how to make money on these facts.

Downward market action on stronger payrolls is telling us to sell, but it is not a selling signal, it’s a buying signal. The market prices events in far in advance of the actual event happening. The market doesn’t think of things as good or bad, but rather as better or worse.

Better gets positive market action, up days, and worse gets negative market action, down days.

The faster people are gobbling up the jobs in jobs-heavy sectors, the faster we get out of this, and can price in better days. Will that be tomorrow, nobody knows, but these are the facts.

Strong payrolls signal a weakening economy, not a strengthening one in our current environment. And investors could be rewarded for playing that side of the fence.