.png)

I’ll preface this post by saying people’s perception of risk changes during times of market distress. Similar to how flying on an airplane is one of the safest forms of travel, yet when you hear about a plane crashing or experiencing extreme turbulence it makes you feel like flying isn’t safe.

Your perceived risk of flying is heightened by the circumstances of the present situation even though that situation doesn’t happen often.

The same thing occurs in markets. Stocks and bonds hardly ever fall in tandem, the usual correlation is negative, meaning stocks rise and bonds fall (and vice versa). That was not this year.

This is the norm for these two asset classes, and even this chart is a little off because of the onset of quantitative easing:

The year 2022 has forever changed people’s perception of risk in both stock and bond markets and a low-interest rate environment broadly caused it. Realistically, bonds only had one way to go, which was up (pushing bond prices down).

Stock valuations skyrocketed as investors tried to find yield and had to exit the bond market. So as 2022 came around there was a lot that was out of our favor, yet that is an anomaly, not the norm. For the most part, 2022 has brought markets back to the norm, that’s not to say that the market will return 30-50% in the year ahead as we saw in 2020 and 2021, 2023’s chart could in all reality look something like 2008’s chart (but for the massive dip we would have to have a systematic collapse, which doesn’t seem likely).

With that said let’s get into it.

Carvana - “The company that invented car vending machines” is now unraveling. Just two weeks ago the company’s credit holders go so spooked that they signed an agreement that binds them to act together in negotiations in bankruptcy court (and Carvana hasn’t even gone into bankruptcy yet). What is even worse is that the used car market is crashing, just looking at CPI data for used vehicles you can see that prices were down 3% in the month of November and now, notably, down 3.3% on the year. That means in the event of asset liquidation Carvana probably won’t even be able to pay its creditors off as selling its used cars in the open market would crash it further.

Affirm - Buy now pay later sounded like a great idea, but I guess when your market becomes instantly oversaturated by the big guys you don’t tend to perform super well. With Apple Pay, Google Pay, and Amazon Pay these guys took market share left and right from Affirm probably because they held all the consumers in the first place on their platforms and marketplaces. It doesn’t sound like they are on the brink of bankruptcy quite yet, but it wouldn’t surprise me to see an acquisition of Affirm (though it must not be too hard of a software to replicate).

Upstart - I shamefully regret owning this at one point, but I took the tax loss and never looked back. Good to see that I wasn’t wrong. Upstart is an online cloud-based AI lending platform. The platform aggregates consumer demand for loans and connects it to its network of the company’s AI-enabled bank partners. This sounds like a great idea with very high margins, but I guess when market participants don’t have an appetite for risk, it doesn’t perform so well.

Rivian - the car company that promises to give you your car in 24 months. The company has a backlog of 100,000 orders yet only delivered 12,000 cars in the third quarter of 2022. Also, this company took down Amazon’s balance sheet by a decent chunk. Maybe our electric autonomous Amazon vehicles will have to wait.

Roblox - Who could’ve thought that a company that has a market of 13-year-olds would do so poorly, probably just about everyone. Roblox is the Metaverse that nobody wants.

Coinbase - Just look at that correlation. As cryptocurrencies collapsed, people thought that Coinbase would still be fine because it generated trading fees. Yet that could not be further from the truth because as prices fell so did trading volume. And now the most recent meme is that Dogecoin has a larger valuation than Coinbase.

Snapchat - the high yield of advertising. As companies slash advertising budgets, who do you think is the first to go? The one with the worst user monetization ever. Most of Snapchat’s ads appear where no users exist. Every quarter this year was an utter disappointment.

Silicon Valley Bank - this one is kind of sad to see because Silicon Valley Bank is actually a great company with an interesting history. The bank holds the cash and debt of start-up companies. And in its early days, it traded with the Nasdaq-100 index because it gave the option to be paid in stock, which mean its balance sheet looked wildly different than other banks. But as startups looked to run down cash before looking to raise their next round, deposits at the bank plummeted. Just wait for the VC pivot though.

Roku - My first question has always been with this company, how do they even make money? I don’t see ads, and if I do it’s to their own streaming platform (which I have no intention of using). Do streaming companies pay to be on Roku and if so, why? Maybe I should look into this more.

Doordash - Talk about the pandemic darlings. I guess it’s not always good for the stock price to pull cash flow from the future.

Tesla - Between an unraveling of risk asset valuations and Elon Musk’s famous acquisition of Twitter, Tesla shares have sunk significantly.

Meta Platforms - The Metaverse that everyone wants but can’t have yet. Investors couldn’t stomach the new strategy, especially in a year when everything seemed to be slowing down. Meta experienced the first negative daily active user growth early in the year and spent billions of dollars on Reality Labs. The future may be bright, but there are short-term headwinds.

Nvidia - High-growth companies that had high valuations suffered in 2022 and even semiconductor companies like Nvidia weren’t immune. The global semiconductor market has been struggling with supply disruptions, but 2022’s global demand slowdown is starting to hurt worse.

Disney - this is literally just a case of the right direction at the wrong time. Disney Plus is one of the fastest-growing streaming platforms and Disney, collectively, has more subscribers than the previous record holder, Netflix. But the media and streaming markets have taken a beating as advertisers trim budgets and people shore up monthly costs. A sad one to see on this list for sure.

Salesforce - any person in sales has some sort of client relationship manager. That is the business of Salesforce, software for better understanding your clients and prospects. It is a high-growth tech stock with high valuations, which pretty much meant 2022 was its worst nightmare. Risk assets went out of favor and companies like Salesforce, Nvidia, Disney, Meta Platforms, and Tesla went out of favor too.

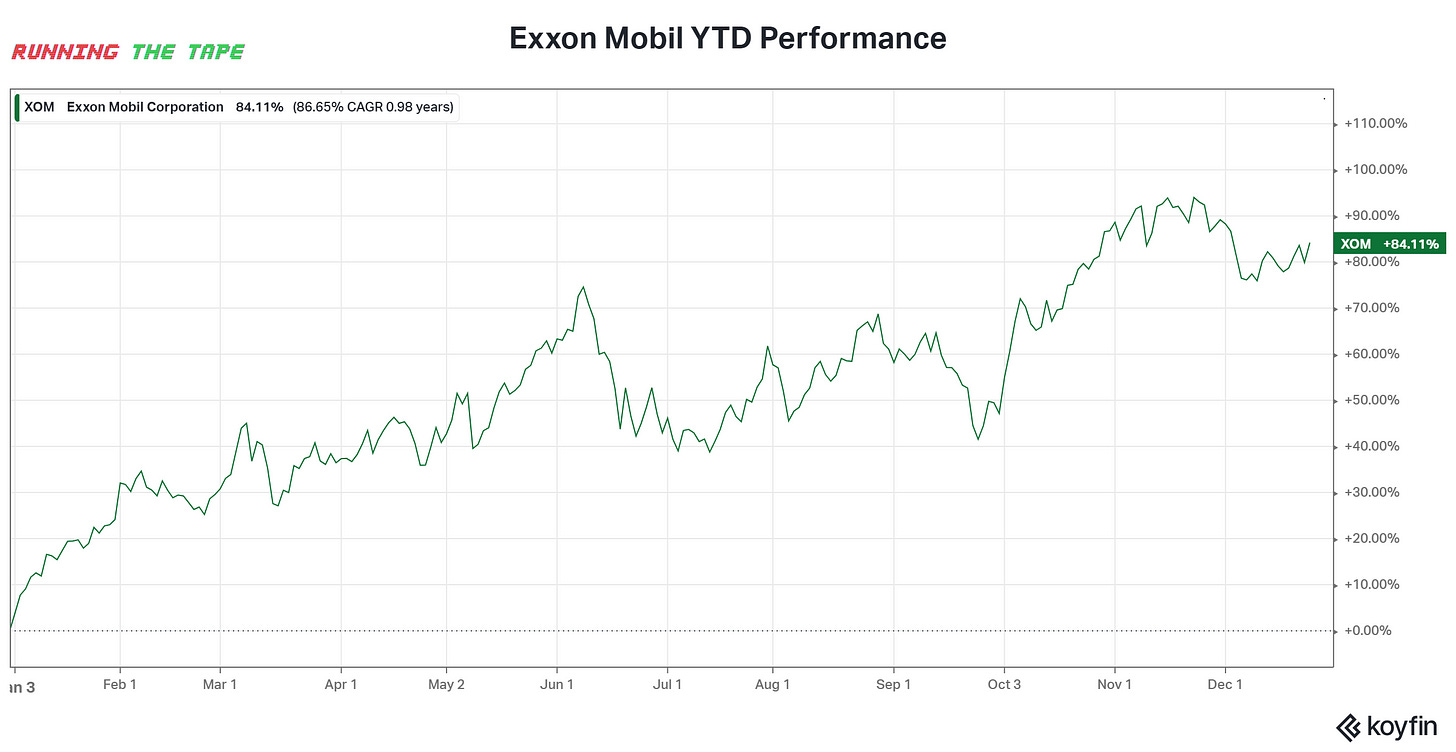

Exxon Mobil - Oil and gas performed incredibly well in 2022 mostly because investors were hedging against inflation and then the war in Ukraine came about after the fact which sent oil prices skyrocketing and oil company profitability skyrocketing with it. They ended up returning a bunch of cash to shareholders. Exxon Mobil performed slightly better than other US oil and gas giants because it produces a lot of natural gas and natural gas saw an extreme rise in price.

Merck - mainly for its strides in its immunology and cancer divisions Merck was able to secure a massive rally in 2022. Merck’s Keytruda was shown to keep patients with melanoma alive longer, then Moderna’s mRNA-4157/V940 combination with Keytruda Merck and Moderna were able to show an early-stage skin cancer vaccine.

Eli Lilly - the company which develops diabetes drugs was able to figure out a drug that could reduce the weight of the patients that it served. The solution is given to patients that have a significant risk of type 2 diabetes in an effort to prevent the disease.

Lockheed Martin - there is a clear relationship between the performance of this defense contractor and the onset of the Russia-Ukraine War, and now again with further threats from Putin that Russia will not be backing down Lockheed began to outperform again.

John Deere - feeding America, John Deere has set out to capitalize on the 20% growth in farmer income after a massive runup in agricultural commodities after the start of the Russia-Ukraine War. Most farmers rather than paying taxes use their profits to buy new equipment. John Deere also is aiming to become the first company to commercialize industrial autonomous tractors, and in 2022 have unveiled and announced its release.

Bristol-Myers Squibb - the company has had several new drugs hit the market and has several that are in the pipeline that provided investors with two things. Security of the future and Bristol-Myers pays a strong dividend.

T-Mobile - the king of 5G T-Mobile has dominated rivals AT&T and Verizon.

Abbvie

Coca-Cola - consumer staple companies certainly aren’t immune to market downturns but if there is anything that no one is giving up it’s beverages and snacks. These companies weren’t overvalued and have a strong dividend giving investors ease of mind.

Pepsi

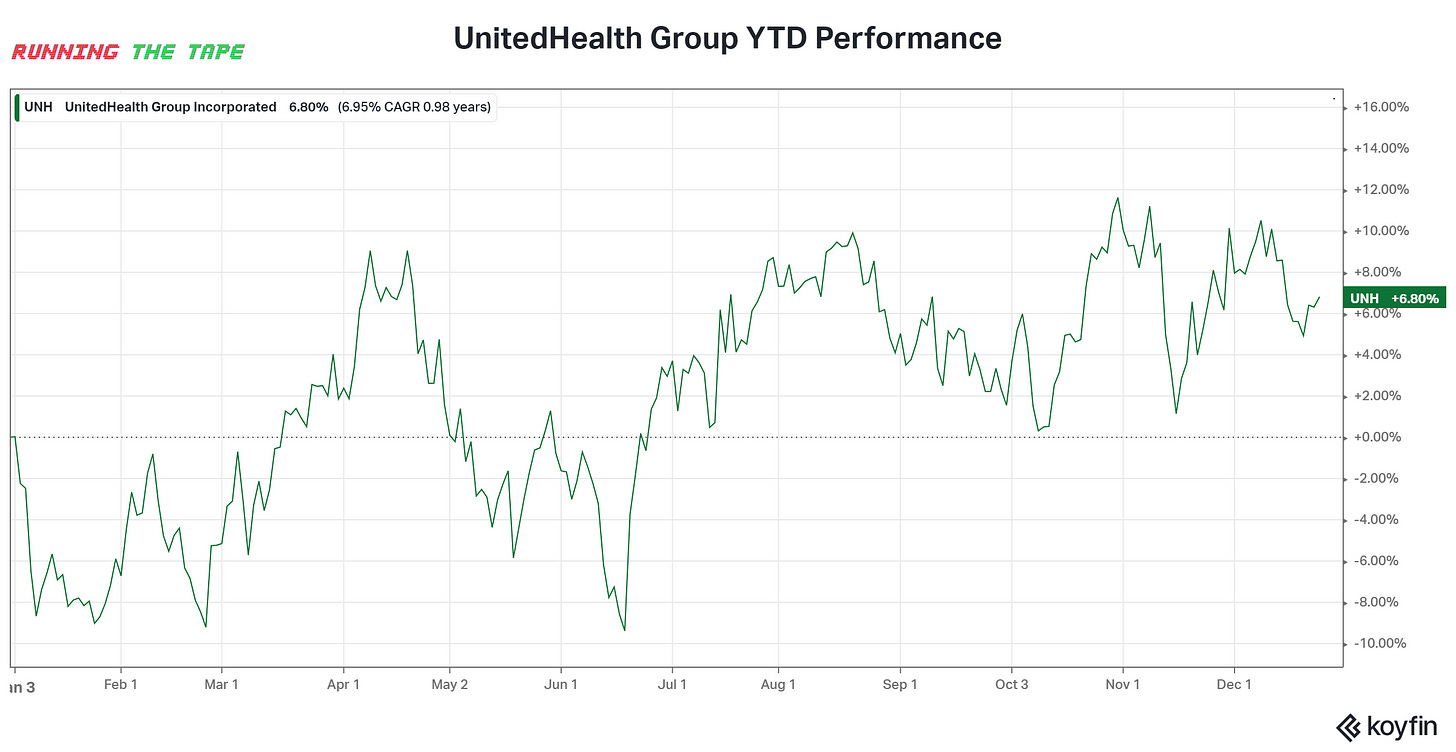

UnitedHealth Group - UnitedHealth is poised to hit its 16th straight calendar year gains.

Johnson & Johnson

Walmart - what is surprising about this entry is its rival Target is down over 35% on the year. Hardline retailers have struggled because inventories were backed up and then demand got crushed just as their inventories arrived. That sent profits lower, yet Walmart showed resiliency.

Phillip Morris - tobacco stocks are known for their dividend because there isn’t usually room for growth. When you are killing your consumers and people are told left and right to quit or never start, it makes sense that you shouldn’t grow. Yet every now and again you get some growth, maybe its the stress, or maybe its just random. But this year showed some price appreciation.

Cheniere Energy - Cheniere Energy holds the ticker symbol LNG, which stands for liquified natural gas. LNG (the commodity) was up 160% at one point this year, and it is still up 36% on the year.

Schlumberger - a company that creates software for the oil and gas industry of course does well when all of the oil and gas companies are doing well, but this is a company that has suffered for years as oil and gas companies descaled operations and pulled back production when prices were lower and at breakevens.

Enphase - tax credits always win in these times. Enphase designs semiconductors for solar panels and with a solar tax credit, it of course benefited.

First Solar

On what I said earlier about how 2023’s S&P 500 chart could look like 2008’s, it remains highly uncertain. There are several variables at play including low valuations (which don’t give a lot of room for lower valuations), peaked and falling inflation, peaking and falling interest rates, and economic instability (or stability).

We are onto a time of seeing what actually comes about from aggressive interest rate hikes. That is our transition from policy risk (speculation on growth) and actual growth risk.

As for what the market could actually look like next year, it’s hard to tell. I won’t and don’t pretend to know and nobody else knows either. We can speculate, but we can’t know.