.png)

We continue to live in one of the most confusing economic environments.

We have low unemployment, high inflation, the fastest pace of interest rate hikes, and an economy teetering between a recession and a soft landing.

All signs point towards a recession, but the pandemic injected so much liquidity into the system that consumers and corporations are strong enough to weather it.

Basically, there are several indicators that are screaming for a recession and several indicators that say we are going to be okay.

It’s for this exact reason that the Fed is worried about inflation and how investor optimism could overturn the work they’ve already accomplished.

Current market pricing tells us what the market expects.

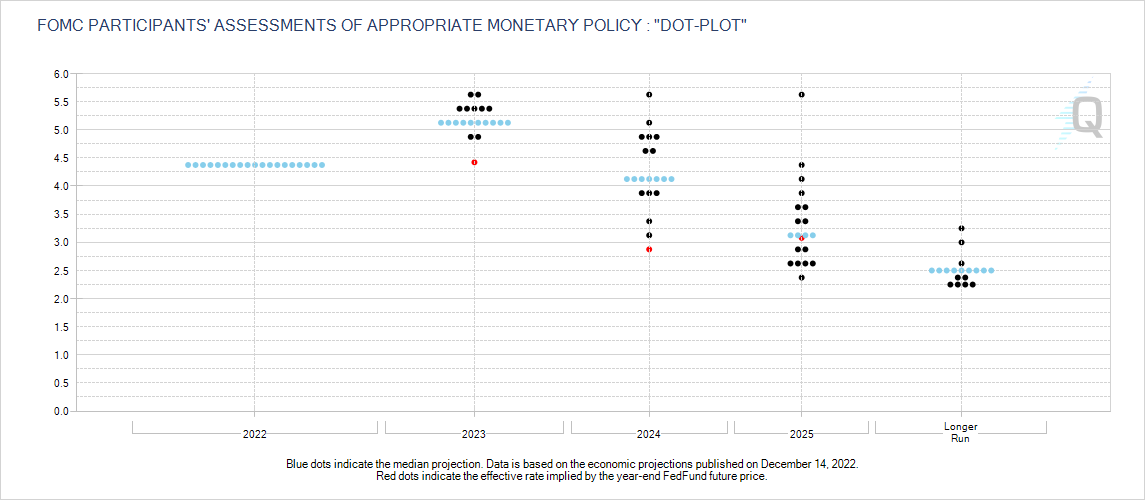

The market expects that the Fed will have to cut/maintain rates at their current level today. Hike to 5% then cut to 4.5% by the end of the year, a much different story than what the Fed is telling us.

Then in 2024, the market says the Fed will cut down to under 3% from 4.5% while the Fed calls for rates to hit its level at the start of 2023, one year after the market is pricing it.

Until the Fed and the market come together at 3% in 2025, although predicting economic conditions even one year out is practically impossible, especially during times like these.

The Fed in 2022 started out by saying there was no way they would hike rates by 0.75%, then proceeded to do it one month later and three times after that.

The Fed implied rate for the end of 2022 at the start of 2022 was just over 2%, versus the real 4.33% it is today.

The bond market has a pretty good track record of predicting the peak rate of the Federal Funds Rate.

Yields on the short end of the curve generally peak before at or higher than the final rate determined by the Federal Reserve and only higher on instances of reversing economic conditions.

This isn’t to say that the short end of the yield curve couldn’t rise over its previous peak, all we know is that is the peak and it is around where the Fed says its final rate will be.

That is a dangerous reality for the Fed.

The Fed needs to slow spending, needs companies to not hire, and needs the economy at large to slow.

If the market starts telling the world that everything is fine, those things maybe won’t happen, at least at the pace the Fed wants them to happen.

In every instance of a pivot pricing event by the market, Jerome Powell has taken a harder stance on the aggressiveness of monetary policy.

When you actually look at inflation it looks like we are heading to deflation. Durable and non-durable goods in the US are trending downward, and durable goods (cars, TVs, etc) are at 0% year over year.

When we have deflation, people wait to spend which is ultimately worse for the economy than high inflation.

What is keeping inflation high is shelter, which I’ve talked about before being ultra-lagged and unreliable in real-time.

Services inflation ex housing has shown flat or negative month-to-month readings. That means in 12 months the year-over-year reading would be at or below the Fed’s target.

At the end of the day, the Fed may be worried about investor optimism keeping inflation high, but I believe that inflation has already substantially come down to the point where the Fed may have a hard pivot from what they’ve said.

I’ve talked about this too on the Laminate Money Podcast.

What that means for portfolio construction is that stocks and bonds will both be in favor, similar to how they were both out of favor in 2022.

Bonds typically recover faster, especially in scenarios like these as investor flood into the debt markets to capture higher yields before they fall. Ultimately most people won’t be on the front end of that trade.

That is something I am already seeing with institutional money. They have all shifted their portfolios to longer dated bonds to try and capture the downswing of interest rates and have higher coupon payments for longer.

In stocks, falling interest rates mean companies can start using leverage how they have for the last 15 years.

Ultimately because of a mild recession on the horizon companies may face some earnings challenges before they see some real benefit. That’s why bonds typically recover faster anyways.